Why is it important for you to have a section 52 professionally prepared?

It is not always clear what people are referring to or what it means when it comes to legislation.

Here at P&B Law, we aim to use everyday language as much as possible when conversing with our clients so that they can understand what is going on.

We’re aware that many other business lawyers in Melbourne may speak legalese to their clients, assuming that they know exactly what is being said, when in actual fact, they don’t and are too timid to admit it.

We never want you to feel lost in a maze of legal terms. In our view, part of our job as your commercial lawyer is to make unfamiliar words commonplace in your vocabulary by clearly explaining what they mean.

As your trusted business lawyers in Melbourne, we aim to guide you through the legal landscape, acting as partners with your business to ensure its ongoing legal health.

Just as you go to a doctor to keep yourself physically healthy, so you should go to a commercial lawyer to keep your business legally healthy. As they say, prevention is better than a cure.

In this article, we will cover the topic of a section 52 – what it is and why it’s important to you as a business owner.

So, what is a section 52?

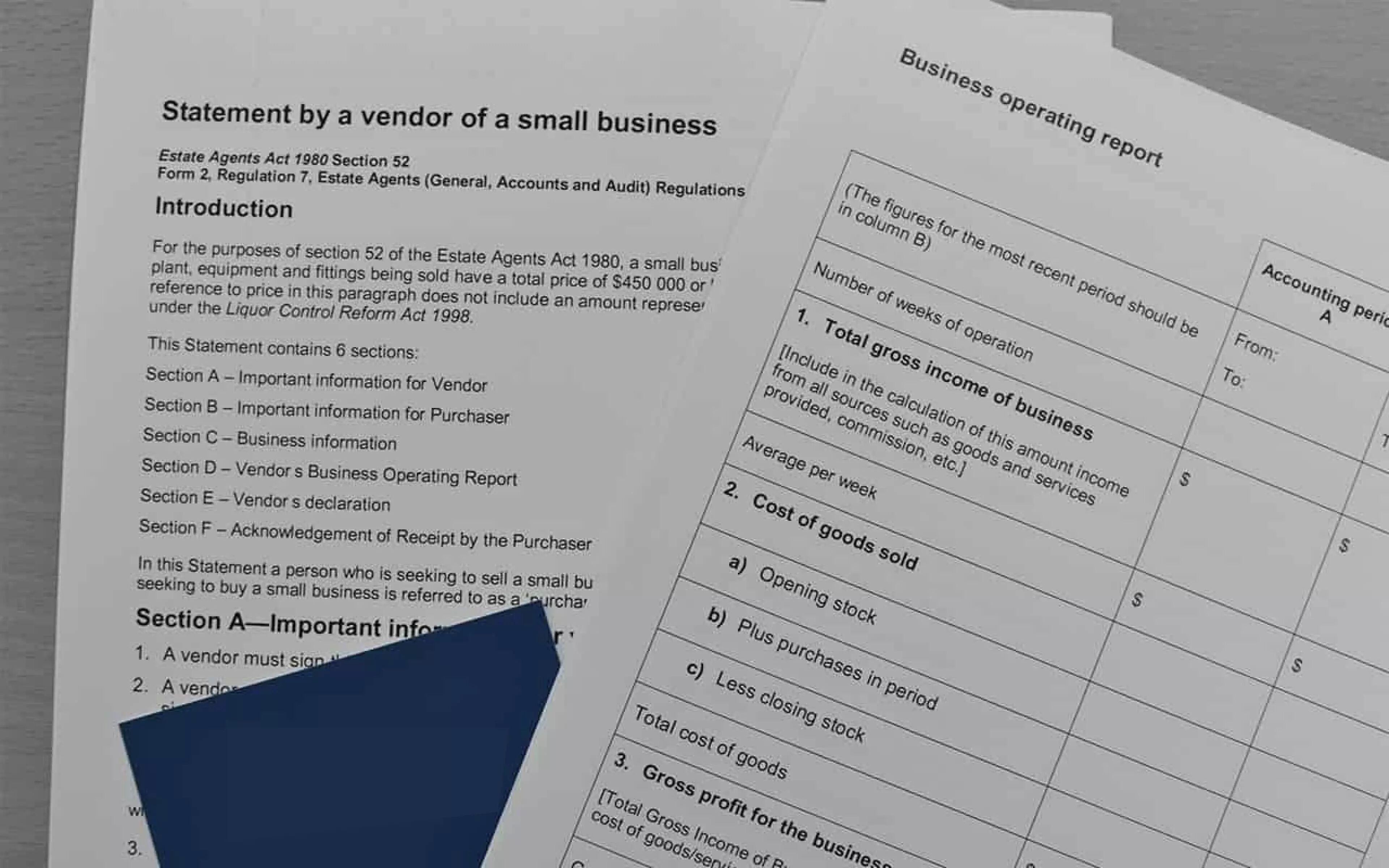

A section 52 is a statement that a small business owner must give to a potential purchaser of their business. It is so-called because it is derived from legislation in Section 52 of the Estate Agents Act 1980, applicable in Victoria.

This statement outlines the current financial performance of a business and is a kind of due diligence on the part of the purchaser, so they know what they are getting.

A section 52 has the following parts:

- Section A – Important information for the vendor

- Section B – Important information for the purchaser

- Section C – Business information

- Section D – Vendor’s business operating report

- Section E – Vendor’s declaration

- Section F – Acknowledgement of receipt by the purchaser

Included in a section 52 will be details of the business operations such as how long the business has been going, whether the company owns or leases its premises, the premises condition, expenses, profits, and debts.

In short, it will provide a snapshot into the health of the business so that the purchaser is well aware of what they are buying.

When does a section 52 apply?

Where a section 52 applies, it is compulsory to provide one to any potential purchaser of your business, and it must be complete, accurate and up to date, as well as signed.

Your business lawyers in Melbourne will be able to tell you if or when you need a section 52. But as a general rule, the sale of any small business in Victoria worth up to $450,000 requires a section 52.

You might be wondering how you calculate the value of a small business. The figure includes all goodwill, plant and equipment, and business fittings. Any stock or intellectual property value is not included in this amount.

Interestingly, there is an exception to this rule – if your business has an active licence or permit relating to the Liquor Control Reform Act 1998 and needs one for operation. So, business owners selling bars or clubs don’t need to provide a section 52.

A good commercial lawyer would also caution you that there are important timings associated with serving a section 52. It must be done before a purchaser signs a contract of sale or a deposit is taken for the sale of the business.

Why should I have a section 52 professionally prepared?

The creation of a section 52 should be a collaboration between you, your accountant, and your commercial lawyer. Like any commercial contract, a section 52 is in the territory of your legal team.

Special expertise is required to ensure that your section 52 is an 100% accurate reflection of your business incomings and outgoings. It is essential that it paints a truthful picture of your business.

A section 52 that is false or misleading can create a lot of problems for you and your imminent business sale.

If a purchaser claims the section 52 is inaccurate, or if the statement is not provided before a contract of sale is signed or a deposit paid, then the purchaser is within their rights to avoid the contract within 3 months of the date of signature.

This means that all monies paid will be refunded to the potential purchaser, and the contract will be void.

So, you can see how important it is to get a trusted accountant and commercial lawyer to help you make sure that your section 52 holds water. A section 52 is just one of the many legal issues a commercial lawyer can help you with.

Why not get in contact with our business lawyers in Melbourne and have a diagnostic on the legal health of your business before it’s too late?

P&B Law – Reputable & relatable business lawyers in Melbourne

We hope that this article will help cast some light on the topic of a section 52 and help fill out your understanding of legal terms.

Here at P&B Law, we always endeavour to empower our clients by clearly explaining legal terminology and what they mean for you.

If you’re looking for business lawyers in Melbourne who are not only knowledgeable but relatable too, then contact us today at P&B Law.